Back to Insight

Black Friday

How AI is changing Black Friday shopping behaviour in 2025

Andy Francos

Nov 28, 2025

How AI is changing Black Friday shopping behaviour in 2025

It’s another high-pressure Black Friday, but the biggest shift isn’t in your dashboards; it’s in shopper behaviour. Consumers are increasingly turning to AI assistants, powered by large language models (LLMs), for product advice, comparisons, and buying recommendations, moving away from traditional methods.

And the pace of change is accelerating. Perplexity recently launched a personalised shopping assistant designed to guide people from discovery to decision. ChatGPT has also released a new shopping research experience that delivers tailored recommendations - much more efficient than a range of choices (ten blue links anyone?). Together, these launches signal a clear behavioural turn: when intent is high, shoppers are starting with AI.

Which begs the question: when people ask AI where to buy, who actually shows up, and why?

We took a look at the top performers across the US and UK in six major AI Search platforms. Google AIOs, Google Gemini, Google AI Mode, ChatGPT, Claude and Perplexity.

Why Amazon dominates Black Friday prompt coverage in AI Search?

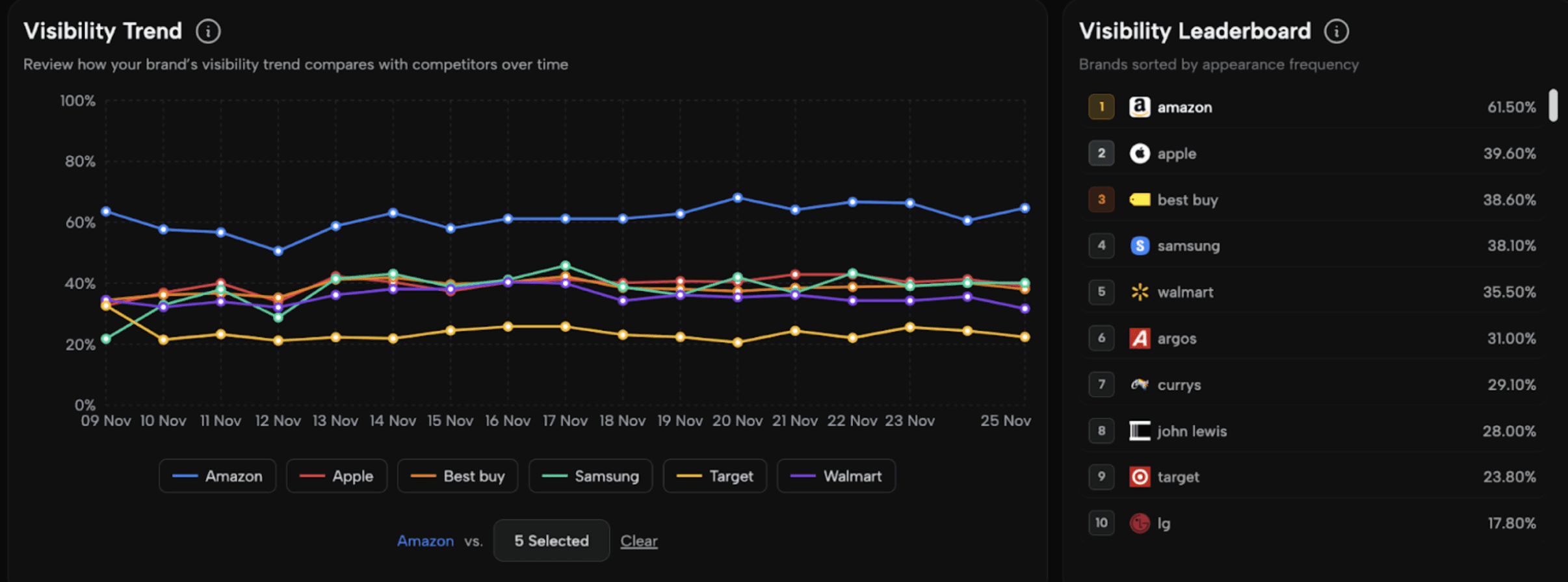

Across all major AI systems, Amazon is the most consistently surfaced retailer for Black Friday prompts, appearing in 61.5% of answers. Apple, Best Buy, Samsung, and Walmart sit much lower at 35–40%.

What stands out is Amazon’s stability. Its visibility barely shifts across models, signalling that AI systems see it as a safe, comprehensive recommendation - especially when a single, confident answer is needed.

US AI search trends: retailers leading Black Friday visibility

US retailer visibility in AI search

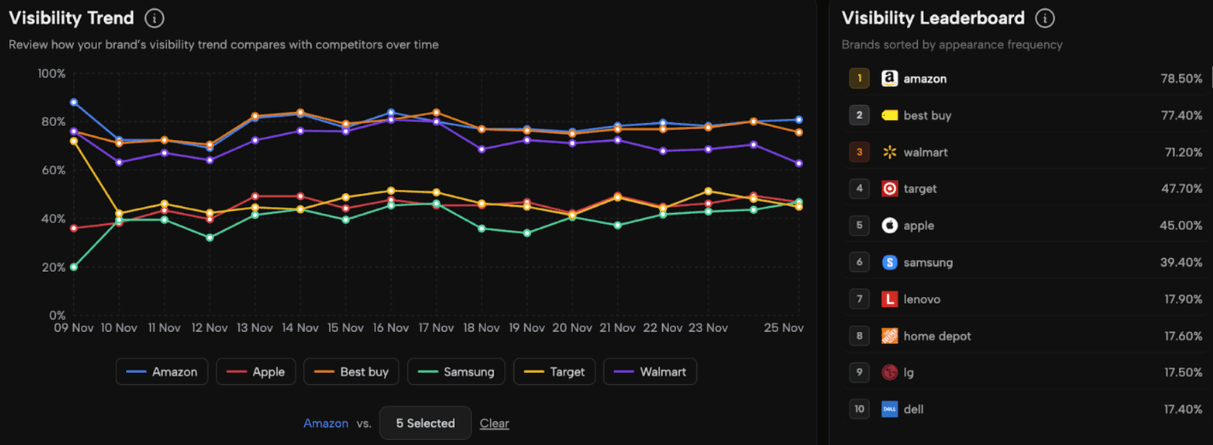

US AI assistants heavily favour large, well-known retailers:

Amazon, Best Buy, and Walmart appear in 70–80% of answers.

Best Buy sits just one point behind Amazon, making the gap surprisingly small.

Target, Apple, and Samsung form a mid-tier at 40–48%.

Everyone else hovers around 17%, barely making an appearance.

It reflects what we tend to see from US shoppers: when Black Friday hits, people gravitate toward major retailers, and AI mirrors that pattern.

Who does AI position the highest?

In prominence position, the hierarchy becomes even clearer:

Amazon leads with an average position of 3.1, consistently near the top.

Best Buy (3.7) and Walmart (4.2) form a strong second tier.

Apple and Samsung (5.4) sit mid-table, mentioned often but rarely positions high.

Target underperforms its visibility at 5.6, frequently included but not great prominence.

LG, Dell, Lenovo, and Home Depot sit between 5.9–7.0, with limited influence.

Movement is minimal. Amazon stays the number one pick, with Best Buy and Walmart the go-to alternatives.

To see the full report, please reach out via our contact form.

UK AI search trends: high-street retailers vs Amazon

UK retailer visibility in AI search results

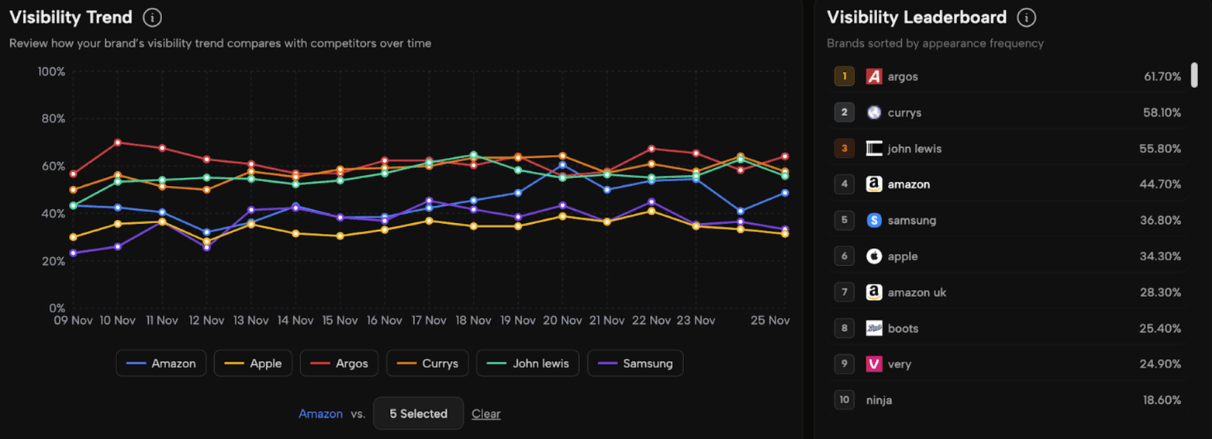

In the UK, the picture shifts dramatically:

Argos leads at 61.7%, well ahead of Amazon — not the result most would guess.

Currys (58.1%) and John Lewis (55.8%) closely follow.

Amazon sits 4th at 44.7%, far less dominant than in the US.

Samsung (36.8%) and Apple (34.3%) remain mid-tier.

Boots, Very, and Ninja show up mostly in category-specific contexts.

UK retailer prominence: which brands AI prioritises

Once you look at prominence, the order reshuffles:

Amazon jumps to number one (2.8) for prominence despite being only fourth in visibility.

Amazon UK (3.1) also positions well, though splitting the entity weakens its footprint.

Currys is the strongest UK retailer at 3.8, outperforming Argos.

John Lewis follows at 4.9.

Argos drops to 5.2, showing high visibility, but weak prominence.

Apple and Samsung (5.9–6.9) appear consistently but rarely near in top positions.

Very, Boots, and Ninja average 7.3–9.5, making occasional but low-positioned appearances.

The UK retail takeaway:

UK AI models surface Amazon first when they include it.

Argos appears a lot but rarely reaches top positions.

Currys emerges as the strongest UK native retailer in terms of authority.

To see the full report, please reach out via our contact form.

Why AI shopping assistants now influence Black Friday sales

AI assistants have stopped playing middleman. Google’s recent expansion of agentic shopping introduced guided research and checkout flows, turning search into a full end-to-end shopping assistant. ChatGPT’s instant checkout feature now lets users research and purchase without leaving the conversation.

AI recommendations are starting to shape where people buy as much as what they buy.

How e-commerce brands can increase visibility in AI search

Visibility is earned by being clear, consistent, and easy for models to understand. Focus on:

Strengthen your entity: Fix naming inconsistencies, ensure unified profiles, and keep your brand clean across news sites, reviews, directories, and retailers.

Cover every sub-intent: Create content for variations like “best X,” “under £50,” “where to buy,” “X vs Y,” and “best for…”. Become the obvious category authority.

Use structured, listable formats: Models favour extractable formats like lists, comparison tables, recommendation blocks, and pros/cons.

Build a factual footprint: Provide clear specs, prices, delivery and returns info, warranties, availability, and original data.

Earn external citations: Appear in “best X” lists, buying guides, gift guides, and review articles. External validation strengthens inclusion.

Optimise for AI retrieval: Keep pages fast, clear and crawlable. Use high-signal summaries and monitor GPTBot logs to identify key pages.

Fill category gaps: Track which competitors appear where you don’t, then build content to close those gaps.

Strengthen structured data: Use Product, ItemList, FAQ, Article, and Organisation schema so AI can easily interpret your pages.

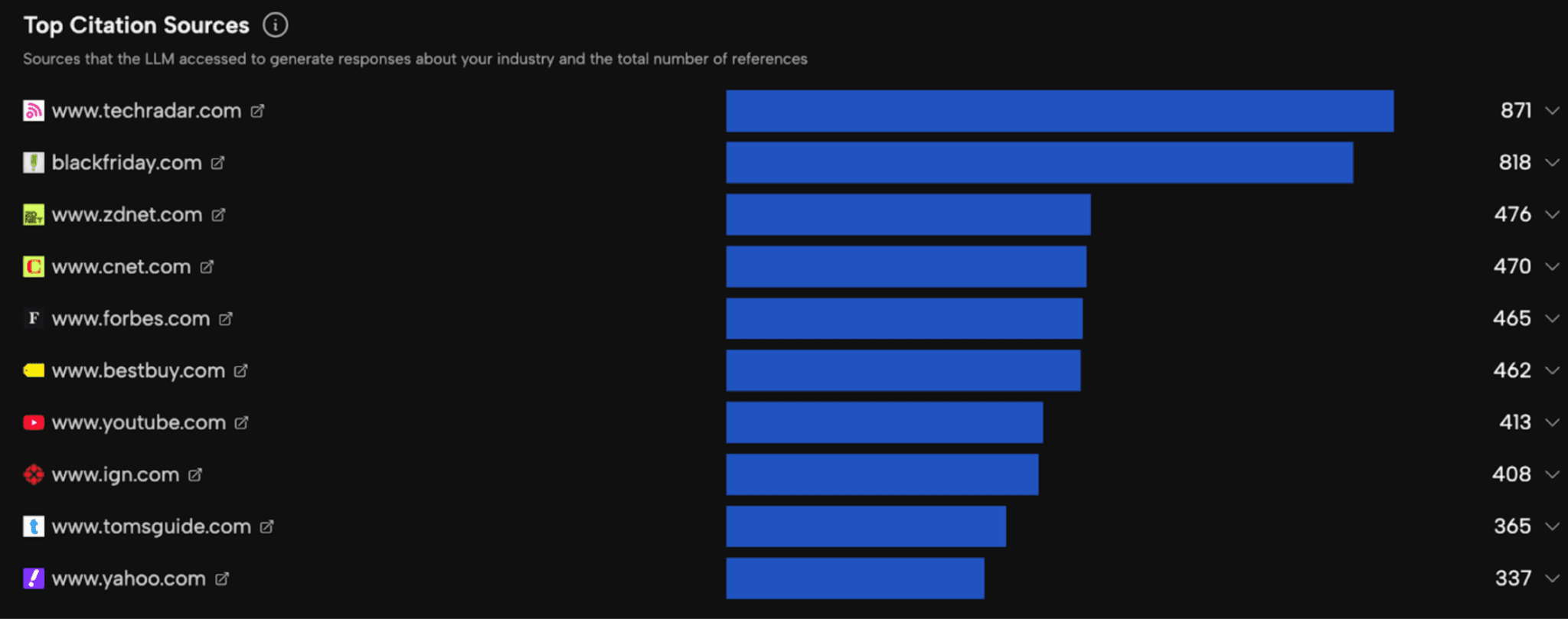

Citations are crucial when tackling AI Search

Citations are crucial in AI Search because they show the sources used to generate an answer. They help users verify information, understand context, and build trust in the response.

When an AI system performs a live web search, it retrieves information from external sources - such as Google, Bing, or other indexed datasets - and generates an answer grounded in those documents. In these cases, the citations point directly to the pages retrieved in real time.

Looking at the Black Friday segment, we see a mix of owned, earned, and paid sources (i.e. affiliate content being cited - you cannot pay to be included as a citation) being cited. This indicates strong opportunities to influence visibility across all three areas: expanding authoritative content on your own site, increasing brand search through ATL activity, and securing coverage in niche publications via PR. Each of these channels can improve your presence in the sources AI systems reference when generating answers.

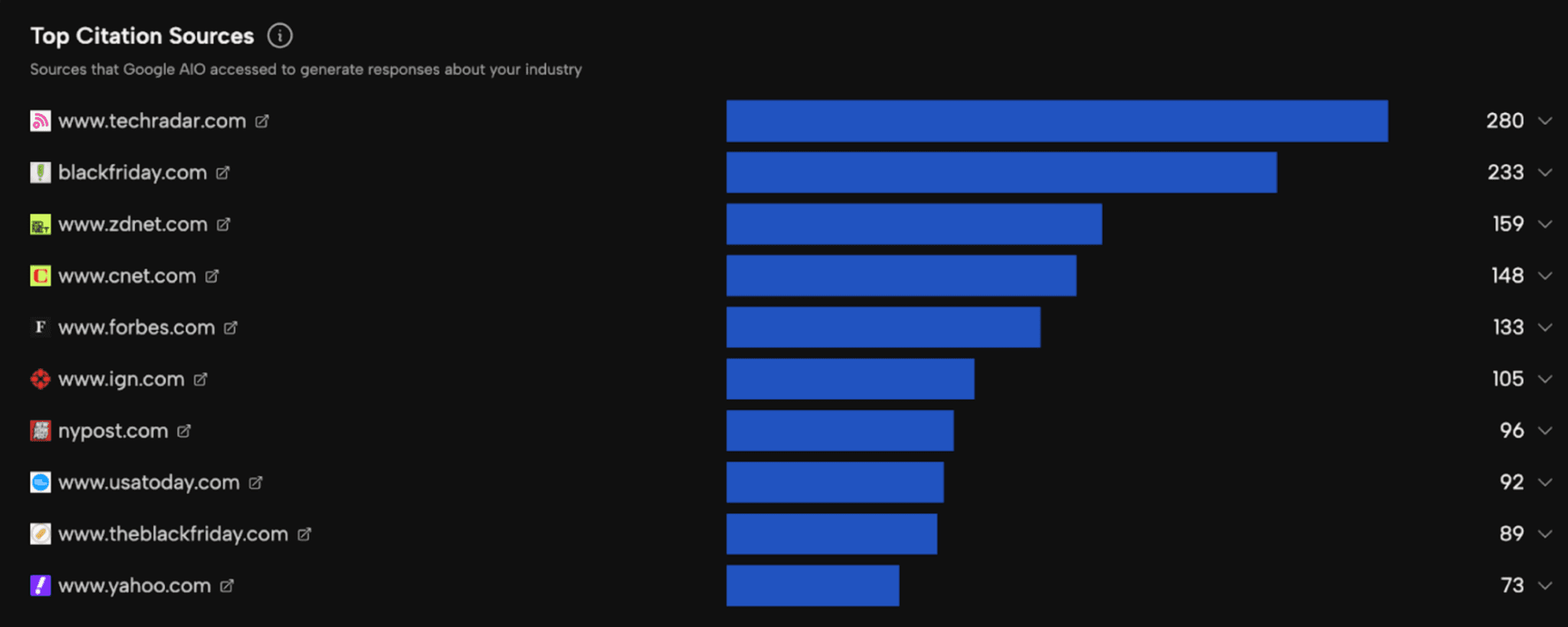

Google AIOs cite tech publications and the dedicated Black Friday website that promote deals from around the web:

Whereas Perplexity references YouTube videos the most, along with UGC content from Reddit and the tech publishers are also in there.

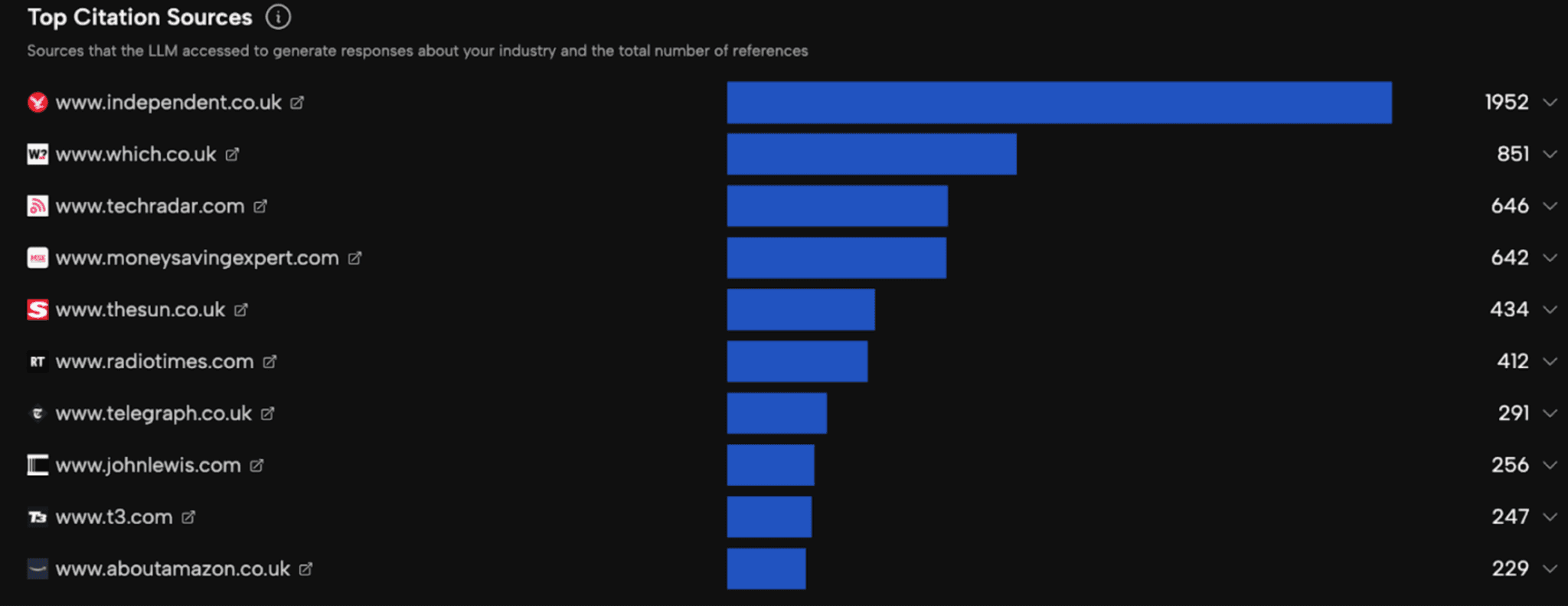

When you switch location to the UK, the citations change dramatically and are localised, with The Independent being the top cited domain by a fair distance:

This highlights the fragmentation across different AI systems with regards to citations, but insights drawn from this are:

More videos explaining your proposition and product (published on YouTube)

Quality affiliates get cited and will change their model to a flat-fee in the era of zero-click

Being cited many times (Bestbuy) doesn’t always mean you’ll be first in the answers - being mentioned many times across authoritative websites is crucial

Key AI search takeaways for brands from Black Friday 2025 data

AI is reshaping how shoppers choose where to buy. Amazon still leads globally, Argos dominates UK visibility, and Currys wins on prominence.

For brands, the next step is clear: optimise for AI search with the same rigour you apply to organic search. Invest in entity clarity, structure, citations and topical depth, and your brand becomes the one AI assistants recommend on the days that matter most.

Growth through intelligence

Capture your brand’s historic visibility, recommendation and sentiment data from AI Search in one intuitive platform

Table of Contents